Allocate Your ESG Bonds Efficiently and Transparently

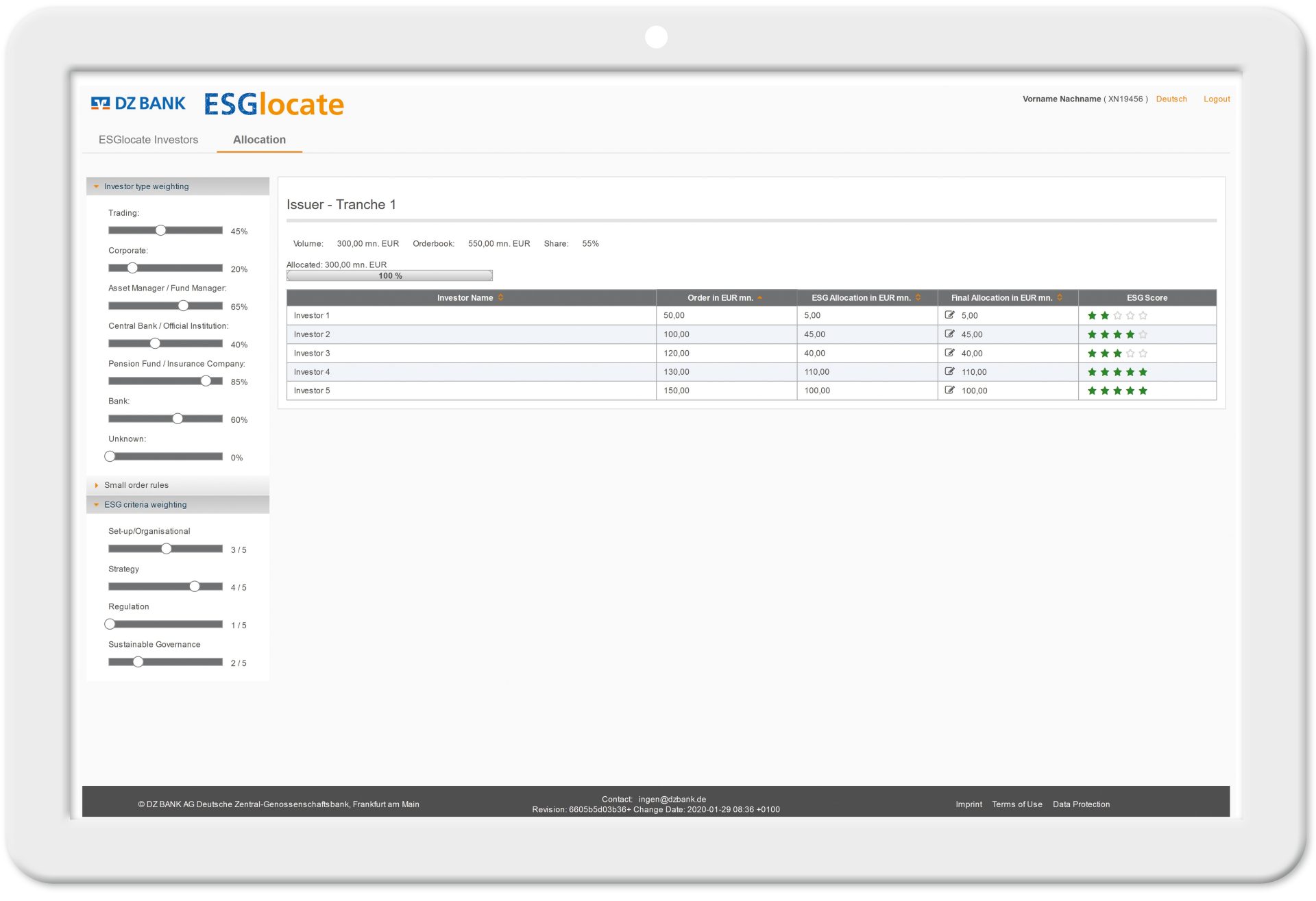

New issues of “Green” or “Social” Bonds are often heavily oversubscribed. DZ BANK's digital tool, ESGLocate, helps issuers to analyse their order-book and identify sustainable investors. The underlying data is based on investors’ answers to a questionnaire about their investment behaviour and the ESG strategies they use.

Progress through Digital Processes

ESGlocate offers issuers a tool which is...

-

...digital:web-based and enables analysis of order-books anywhere

-

...individual:custom-made allocation proposal based on pre-defined sustainability criteria

-

...efficient:targeted allocation of sustainable bonds

-

...fast:each allocation proposal generated in seconds

Tailor-Made ESG Allocation For You

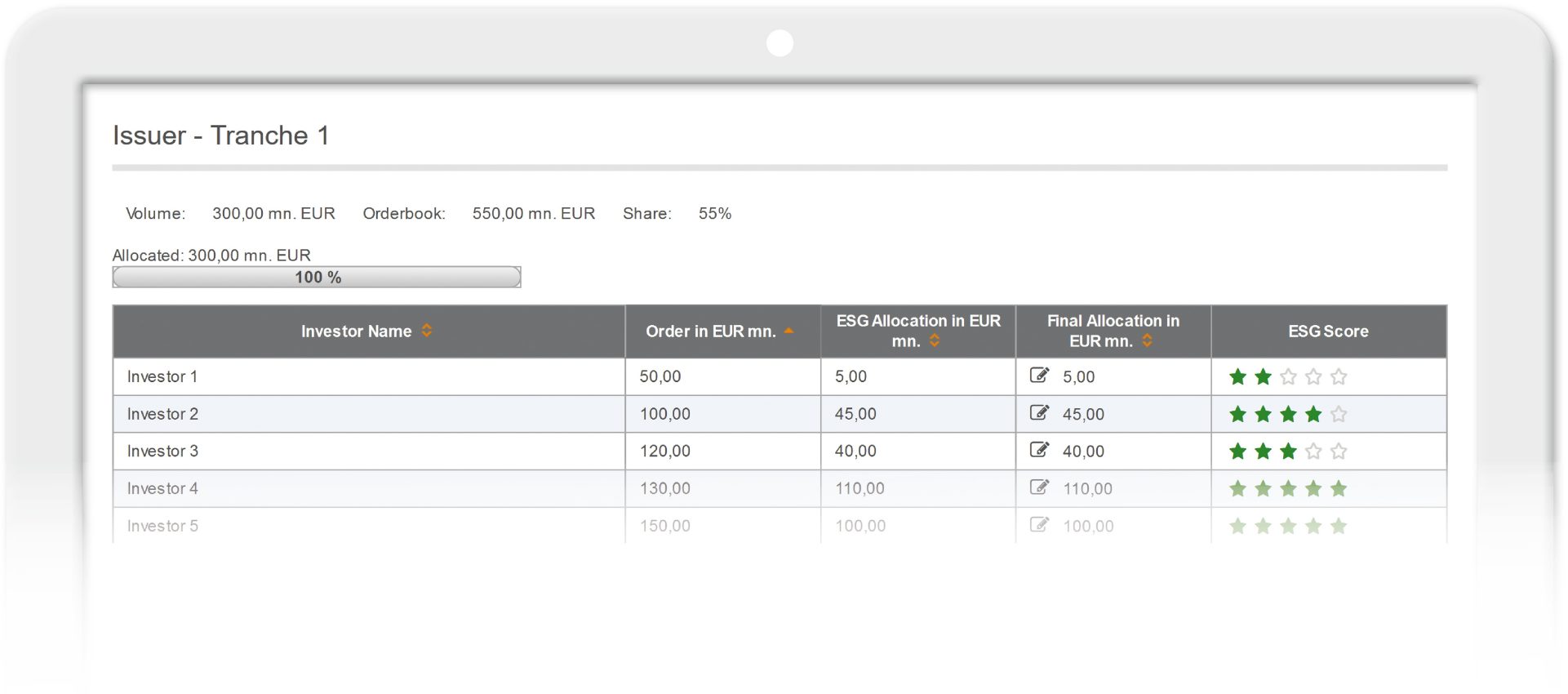

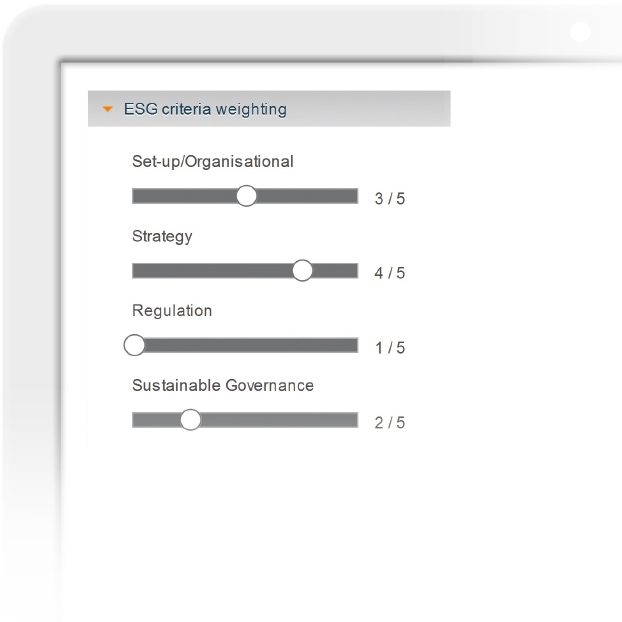

Each time they use ESGlocate, issuers can give greater weight to the indicators that are important to them, and receive a proposal as to what volume should be allocated to individual investors in the order book of their bond. Thus, issuers can identify suitable investors more precisely by using their pre-defined sustainability criteria, and create transparency and traceability by using ESGlocate.

Allocate Your ESG Bond Using Four Broad Criteria:

- Set-up / organisational

- Strategy

- Regulation

- Sustainable Governance

Transparent and Efficient Analysis and Allocation of Your ESG Bond Order-book ...

... by assigning an ESG Score (based on your ESG criteria weightings)